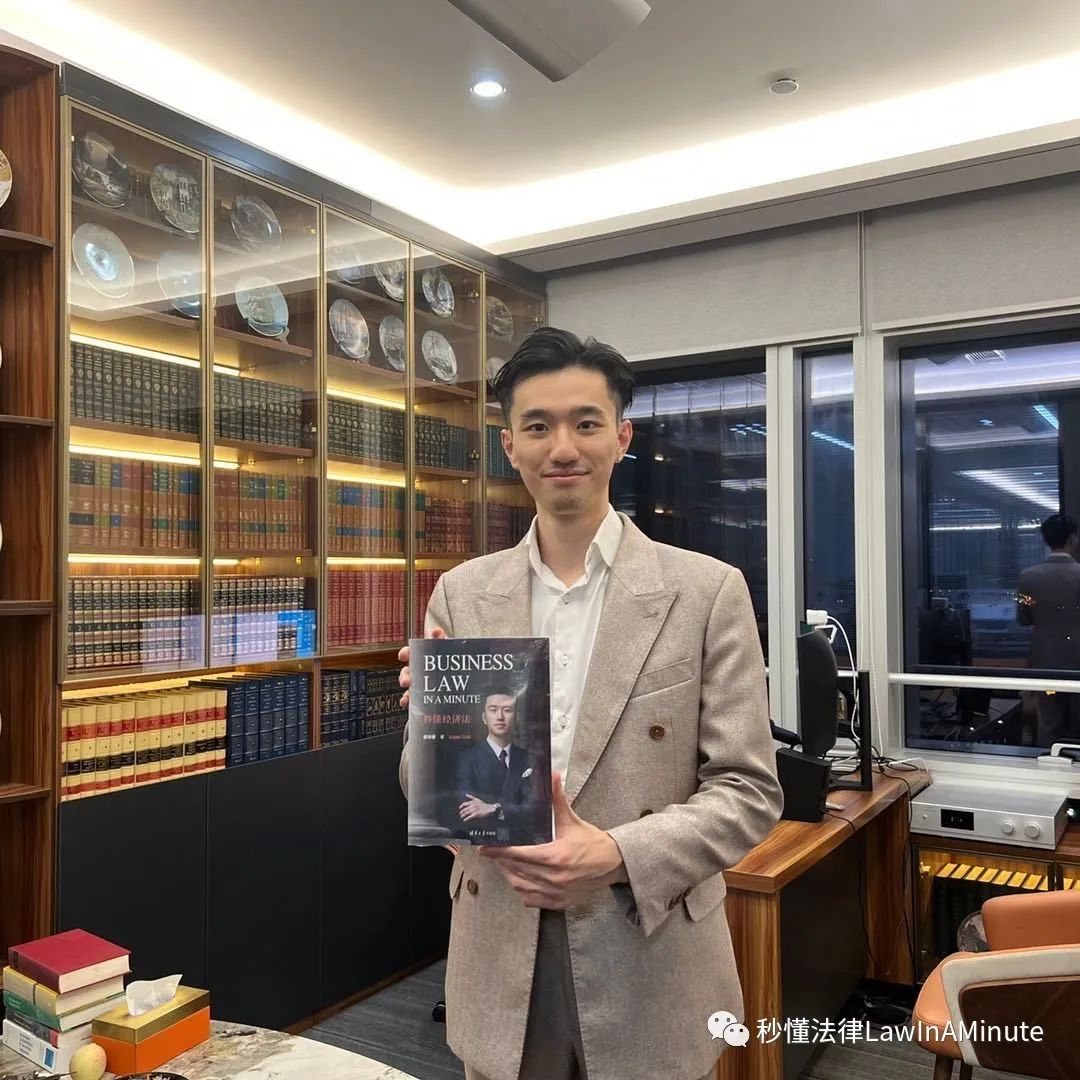

·About The Author·

- Author of Chinese Law Books: Intellectual Property, Commercial, Company and Economic Law In A Minute

- Author of English Law Book Business Law In A Minute

- Co-Author of Peking University Textbook: Business Ethics

- Graduated from Fudan University Law School

- Interviewed by Bloomberg and Timeout

- Mentor at Bloom Education (Charity)

Wechat: lawinamin

Email:[email protected]

Today we shall explain what social insurance is, what commercial insurance is, whether social insurance is compulsory for expats, and what to do if your employer refuses to pay for it.

Social insurance, also called social security, is comprised of fivetypes of insurance: (1) Pension, (2) Medical, (3) Maternity, (4) Work Related Injury and (5) Unemployment. Generally speaking, you pay around 10.5% of your salary as your social insurance contribution per month, while your employer pays around double of this amount. For example, if you earn 25000 per month, you contribute 2500 and your employer pays 5000.

On the other hand, commercial insurance is private insurance paid to a insurance company like AXA, Prudential, or Berkshire Hathaway. Anybody can buy any type of commercial insurance, and a good example would be the insurance that I buy for my car via PICC. It costs me around 10,000 per year, covers the cost of my car if it gets destroyed, and most importantly covers me up to 3 million RMB if I hit somebody accidentally. You can buy all kinds of commercial insurance for basically anything, from insurance for your apartment in case of fire, insurance for flight delays and even insurance for your pet dog or cat. Anyways, commercial insurance is much cheaper than social insurance if your employer is only getting you medical insurance instead of all 5 kinds, so now you know why they might want to skip on this.

So the answer to the question of today is that social insurance is compulsory for expats and Chinese alike. Your employer is supposed to enroll you within 30 days of employment, and you will get a card with your face and social security number on it. You can swipe this card at a public hospital when you need to see a doctor, and get up to 90% off discount regarding medical expenses. The easiest way to find out whether your social insurance has been paid for is to ask for this card.

If your employer refuses to pay for your social insurance, you have two options. The first option is to terminate the contract based on social insurance not paid, as this is illegal, and sue them for severance pay. You can get a handsome amount when you retire or leave China for good, so that’s actually an amount to consider if you plan on working here for quite some time. The second option is to file for a complaint at the social insurance bureau. You can do either of these, or both of these as you want.